Vantage Plus Research Team

May 29, 2024

Fundamental data

Probably the most important topic last week was the launch of the anticipated ETH- ETF. The authorization came as a surprise and was hardly expected by any market participants. On the contrary, there had previously even been negative comments on this issue. Prior to this, there were also comments from the Chairman of the SEC, Gary Gensler. He stated that he would wait for the court judgement before granting approval.

The question may now arise whether ETH will also face a further sharp rise, as was the case with Bitcoin in January.

Technical analysis:

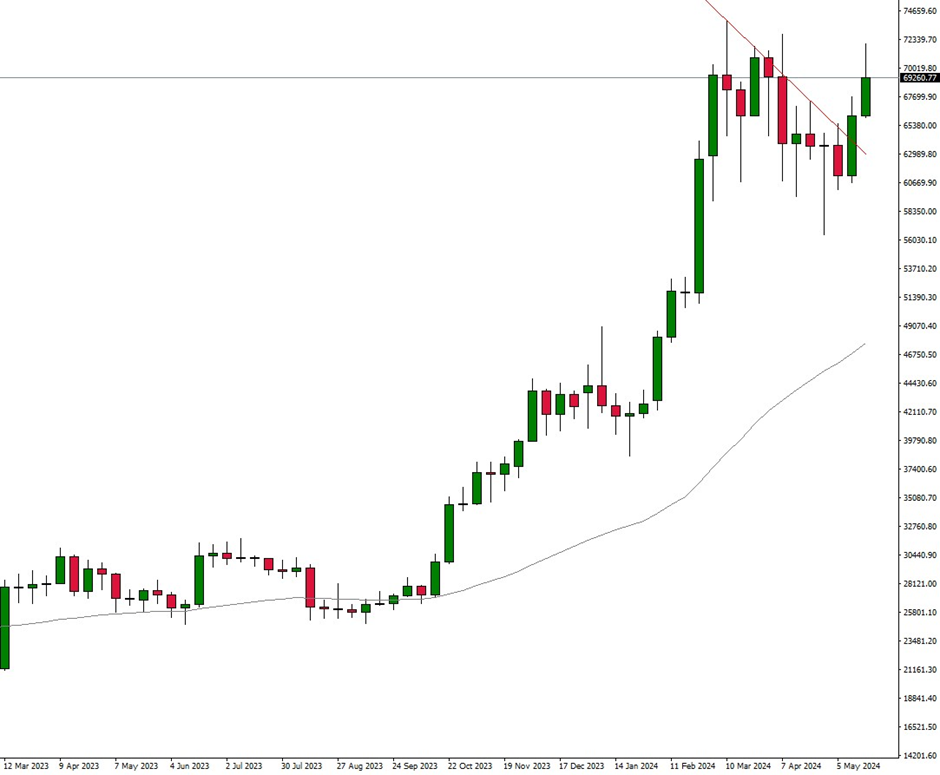

– BTC: Bitcoin is trading at USD 69,270 and was thus able to recover further last week. The broad support zone in the USD 60,000 range appears to continue to have a positive influence on the market.

The falling red trend line continues to indicate that the market could move upwards, although the long-term monthly chart also shows that the positive trend appears to continue. The all-time high is not far away, provided that May settles close to the current prices or higher.

– ETH: Ethereum is trading at USD 3,740.00 and the chart clearly shows a further upward trend. Although the market is still trading below the important psychological price of USD 4,000, it could soon tackle it.

The daily chart shows that the market is currently in a consolidation phase, which could quickly open up further potential towards the all-time high if the highs of the last few days are broken. The price mark around USD 3,900 should therefore be watched closely. The coming weeks should then show whether the ETFs will really trigger strong potential in markets.

– XRP: Ripple is trading at USD 0.5400 and shows little change compared to the previous week. Although the bottom formation and thus the slight upward trend could be defended further, the market failed to rise sharply.

On the other hand, it could now also be decided whether there will be a new attack on the 50-moving average, which is currently acting as a resistance zone. If this zone is broken, the market could move up to the USD 0.6200 area. The psychological price mark at USD 0.6000 will play an important role here.

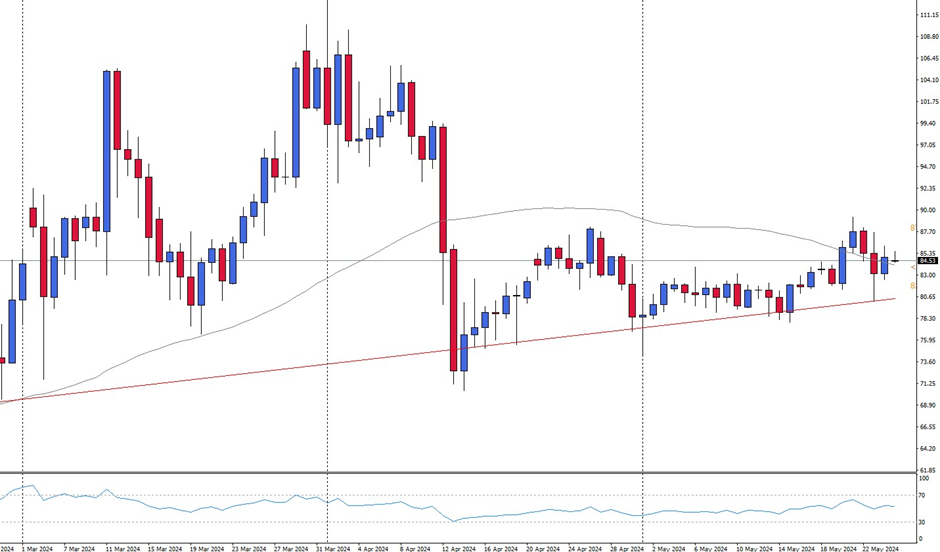

– LTC: Litecoin is trading at USD 85.25. According to the daily chart, there is no further potential here, although the market is currently at an important point.

If the important 50- moving average is broken upwards, new upward potential could ultimately emerge. Although there was certainly upward potential last week, this appears to have fizzled out again, and a new attempt to break above the USD 90.00 zone should be awaited in order to see rising prices.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

About Us

Premium Client

Premium Trading

Complimentary Resources